We took a deep look into M&A and IPO deal trends activity during 2020 in the ICT market with a focus on the European arena where possible. Our analysis has uncovered a very strong trend in this sector with plenty of opportunities.

The year 2020 was a complicated year with the health crisis leading to serious consequences that have expanded worldwide. Even though the pandemic has hurt the broader economy, the ICT sector has been less impacted.

Consumers and businesses are investing more and more in technological infrastructure and hardware to aid with the move to remote working, eCommerce, DX, as well as for private use. This has resulted in a flourishing deal environment, which is likely to result in record-breaking volumes in 2021.

Many companies are looking to the future and are implementing solutions that promote efficiency, security, and are user friendly. This need for technology is making ICT companies attractive in the deal world, not only in the context of mergers and acquisitions, but also in the IPO context.

We took a deep look into M&A and IPO activity during 2020 with a focus on the European arena where possible. Our analysis has uncovered a very strong trend in this sector with plenty of opportunities.

European market

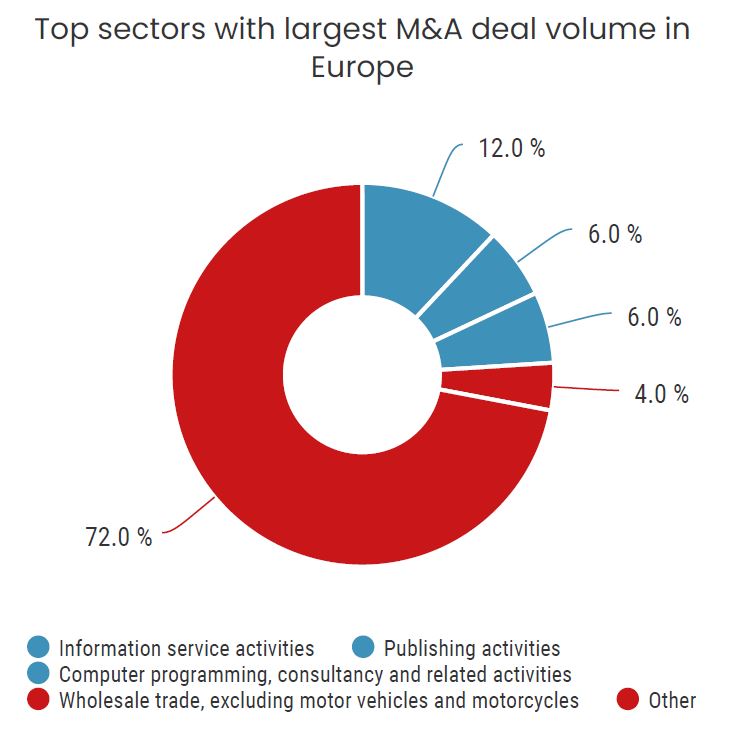

The following graph depicts the top European industries/sectors in 2020 (classified by NACE Rev.2 code for classification industry purposes) with the largest transaction volume (Acquisitions (majority stake), MBI / MBO, Joint-ventures and Mergers).

The top sectors include:

- Information service activities (12%)

- Publishing activities (6%)

- Computer programming, consultancy and related activities (6%)

Source: Zaphyre database

classified by NACE Rev.2 code (100%=4903)

Italian market

When taking a look specifically at the Italian market, the following graph shows the top industries/sectors in 2020 (classified by NACE Rev.2 code for classification industry purposes) with the largest transaction volume in Italy (Acquisitions (majority stake), MBI / MBO, Joint-ventures and Mergers).

We can see a clear trend with the top sectors:

- Information service activities (8%)

- Computer programming, consultancy and related activities (7%)

- Publishing activities (5%)

Source: Zaphyre database

classified by NACE Rev.2 code (100%=475)

M&A in the ICT sub-categories

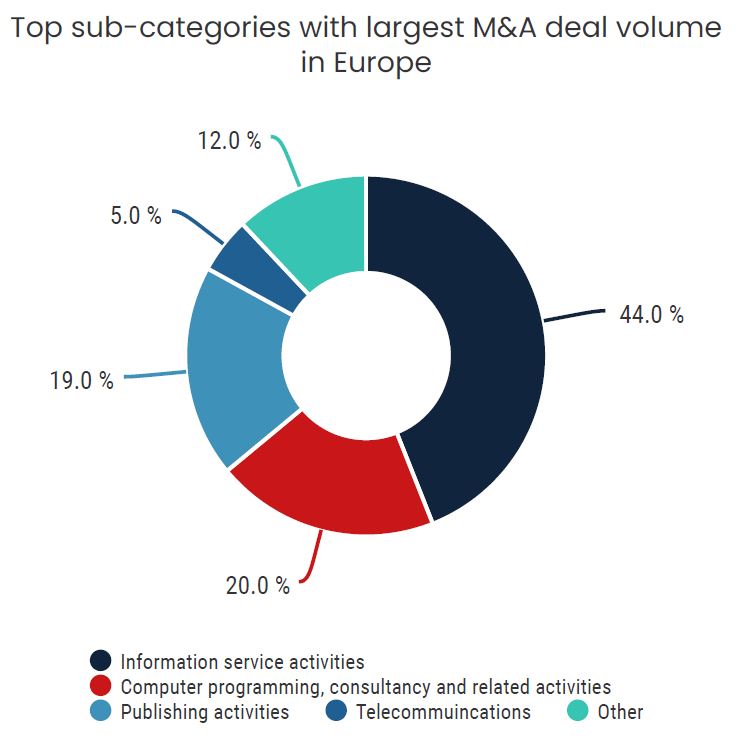

Within the ICT industry itself, the following graph depicts the top European ICT sub-categories in 2020

(classified by NACE Rev.2 code for classification industry purposes) with the largest transaction volume (Acquisitions (majority stake), MBI / MBO, Joint-ventures and Mergers).

The top sub-categories in terms of deals include:

- Information service activities (44%)

- Computer programming, consultancy and related activities (20%)

- Publishing activities (19%)

- Telecommunications (5%)

Source: Zaphyre database

classified by NACE Rev.2 code (100%=1332)

ICT deals by target country

When taking a look at target countries in Europe, the following analysis depicts the breakdown by deal volume in the ICT industry (Acquisitions (majority stake), MBI / MBO, Joint-ventures and Mergers).

The top target countries include United Kingdom, followed by Netherlands, Germany, and Italy (7%).

Source: Zaphyre database

classified by NACE Rev.2 code (100%= 1332)

Part 2: IPO transactions in 2020

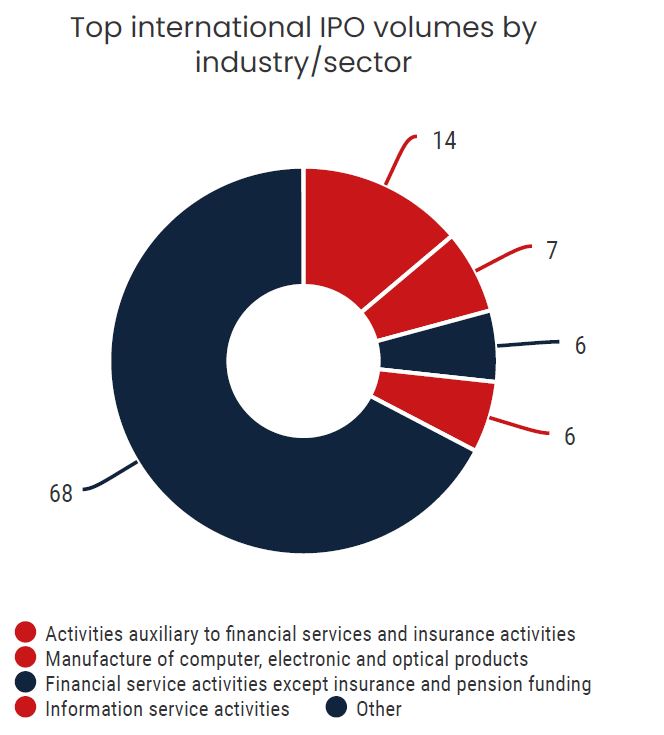

International transactions

The following analysis takes a dive into the IPO context. The graph depicts top worldwide industries/sectors in 2020 (classified by NACE Rev.2 code for classification industry purposes) that

had the greatest volume of IPOs (confirmed and announced).

The top include:

- Activities auxiliary to financial services and insurance activities (14%) – although not strictly an ICT sector, part of this will include financial services closely linked to ICT.

- Manufacture of computer, electronic and optical products (7%)

- Information service activities (6%)

Source: Zaphyre database

classified by NACE Rev.2 code (100%= 3178)

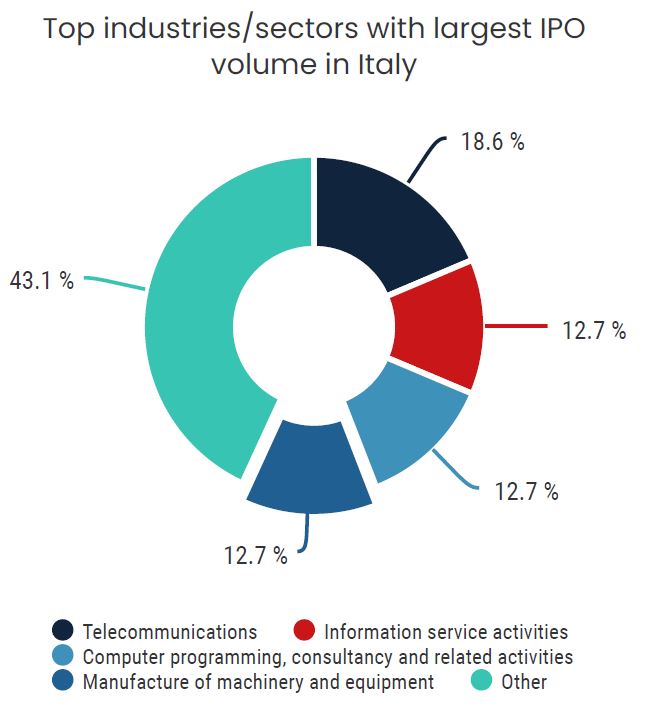

IPOs in Italy

Additionally, within the Italian market, we wanted to show the industries/sectors in 2020 (classified

by NACE Rev.2 code for classification industry purposes) that had the greatest volume of IPOs (confirmed and announced).

The top three are strongly linked to ICT including telecommunications (19%), information service activities (13%) and computer programming,

consulting and related activities (13%).

Source: Zaphyre database

classified by NACE Rev.2 code (100%= 16)

Although 2020 has been a difficult year for many industries on an international level, some industries have seen an exponential increase. The international pandemic has led to the need of implementing technology solutions in order to improve working, living and overall wellbeing conditions. Many companies are looking into the future and focusing in the ICT world in order to improve efficiency and manage activities in the best way possible. This need for technology has created a trend in the deal world that will probably keep on growing exponentially.

Stefania Gaggini, Senior Analyst

Disclaimer: Knet Project, a management consulting firm, has the intention,

here, of sharing market-related insights. Please note that information and

data located in our market insights reports are for informational purposes

only, are general in nature and are not intended to – and should not – be

relied upon or construed as a legal or commercial advice regarding any

specific issue or factual circumstance. The analysis and graphics contained

in our market insight are obtained from authentic sources and exclusively

based on our database which must be intended as a sample-size and never

as a population-size. We take great care in ensuring the reliability and

accuracy of information published by us. In the end, the information here

included is not intended to create a commercial relationship between you

and Knet Project.